Usecase

Digital transformation in financial services is driving the innovation of products to service accountholders in new and evolving ways.

Problem Statement

“It’s no longer enough just to serve (accountholders) when they walk into our offices. We need to be able to serve them where they’re currently working.”

The Opportunity

Evolving with the Consumer

Digital technologies have unshackled American consumers, who are taking advantage of innovative products that enable them to bank on the go, at their convenience. This digital revolution, however, has elluded many community banks and credit unions, which are operating with little technology of their own. Without their own solutions, financial institutions

(FIs) are limited to servicing accountholders and prospects from the confines of their physical locations. This equates to missed opportunities and a growing disconnect from the needs of the market.

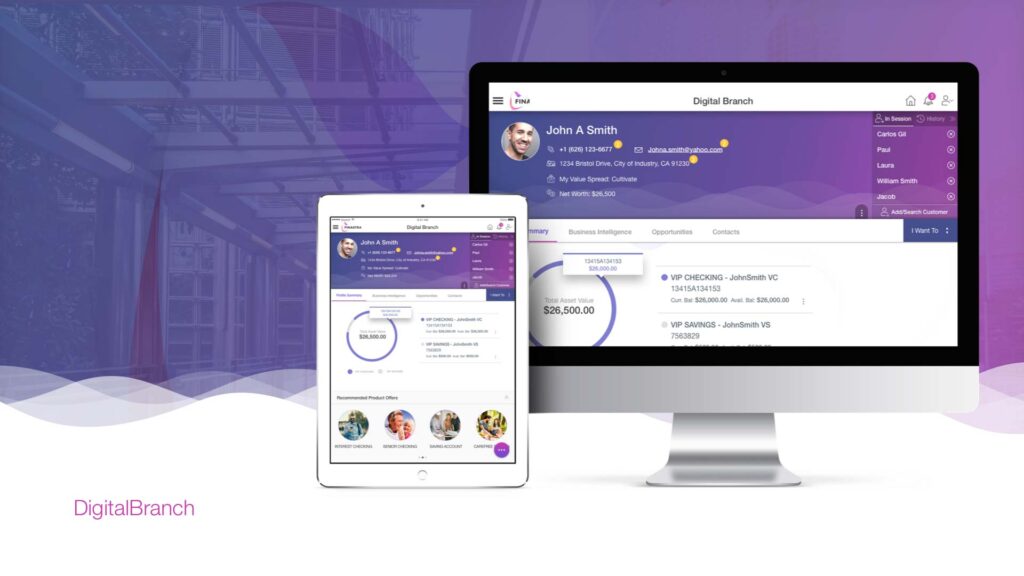

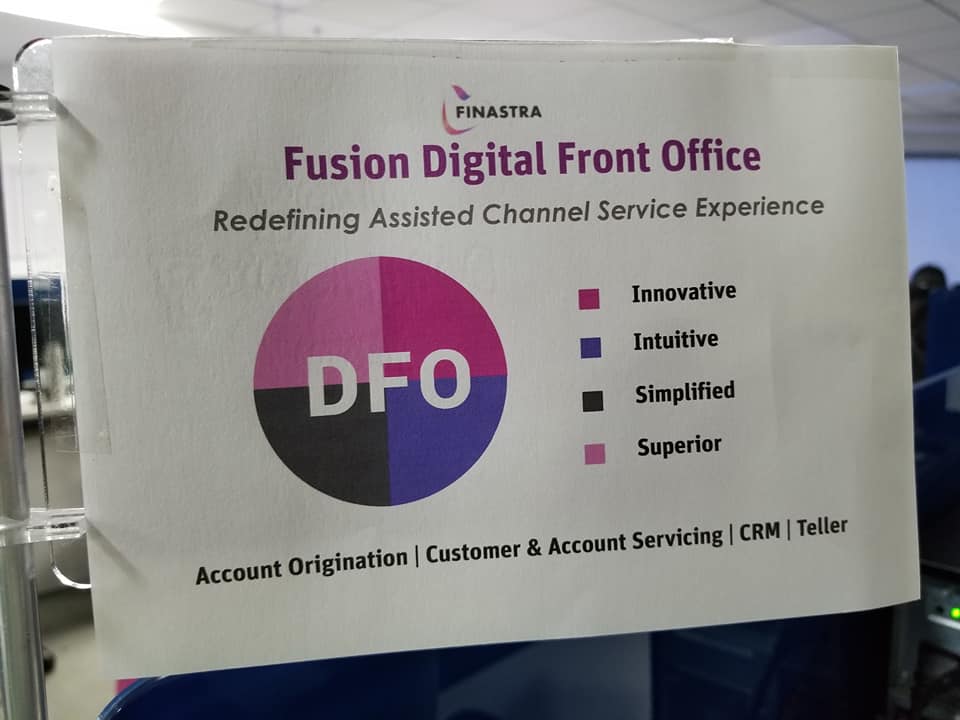

The Next Generation in Digital Branch Solutions

Fusion Digital Front Office is a revolutionary way for financial institutions to take banking to the accountholder. A single, front-end solution for managing account origination, sales and service, and transaction processing, Fusion Digital Front Office provides credit unions and banks with a simple, unified approach to servicing consumers from any remote location. I

Want to View Detailed Case Study? Click Here

Project Outcome

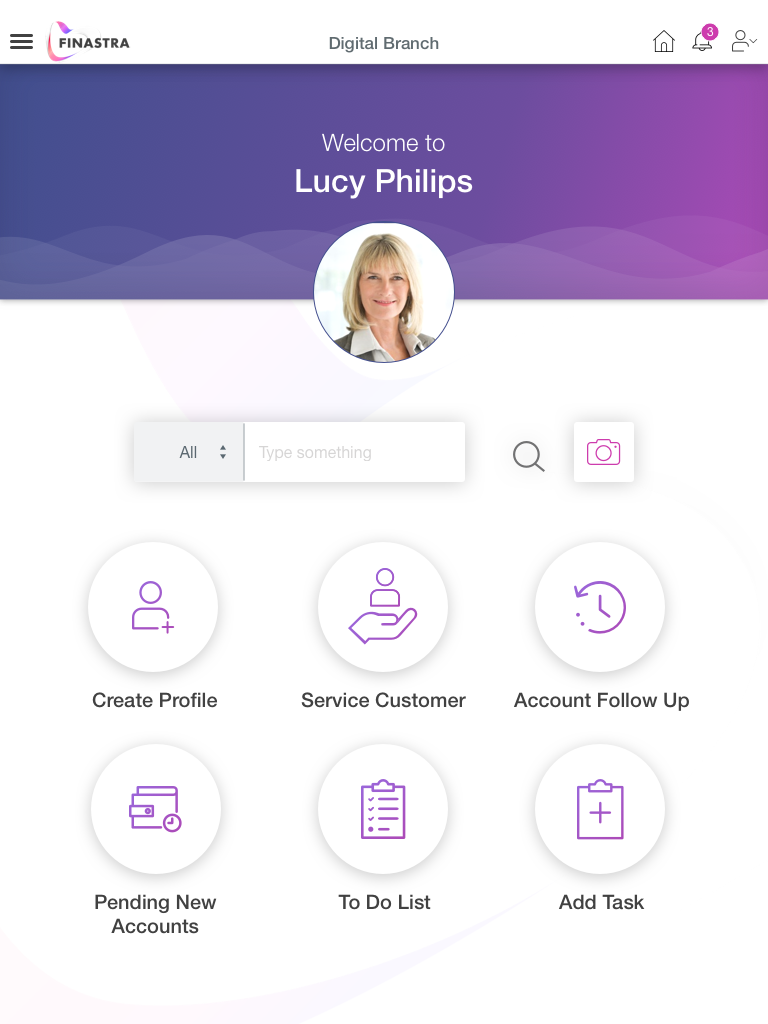

Designed for the Times With a 360° Accountholder View, so You Can Focus on Building Relationships

All accountholder data is accessible and actionable through a single-sign on and with any device, thus empowering community banks and credits unions on-to-go.

- Support APIs and third-party integrations

- Streamline with Finastra’s end-to-end solution for a single vendor • Reduce and control system costs with integration

- Own the institution’s data

Operational Efficiency

- Drive personalized digital experiences

- Reliably, rapidly and compliantly handle more transactions, such as new account origination, from anywhere

- Streamline training with highly-configurable responsive design

- Attract and retain employees with digital capabilities

- Reduce time spent on high-volume, low-value-added services

Untethered Accountholder Servicing

Fusion Digital Front Office allows financial institutions to service accountholders

and accounts using any device so teams can open new accounts, and conduct transactions. It offers a 360-degree view of accountholder activity and provides client relationship management capabilities for a completely untethered servicing experience. The solution’s mobile and responsive design provides highly configurable options for financial institutions to more conveniently service accountholders.

“It’s no longer enough just to serve (accountholders) when they walk into our offices. We need to be able to serve them where they’re currently working"”

Josh Cook, CEO Community Choice Credit Union

Recent Comments